皆が売る中で誰が株を買っているか

One

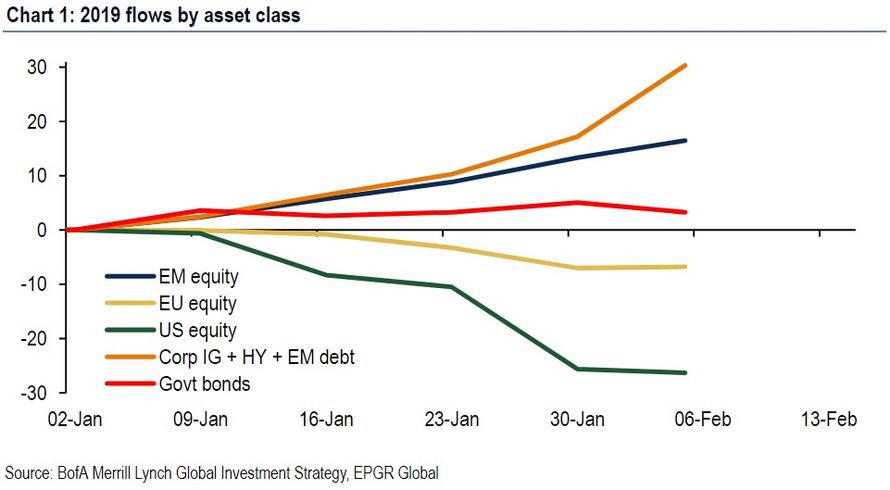

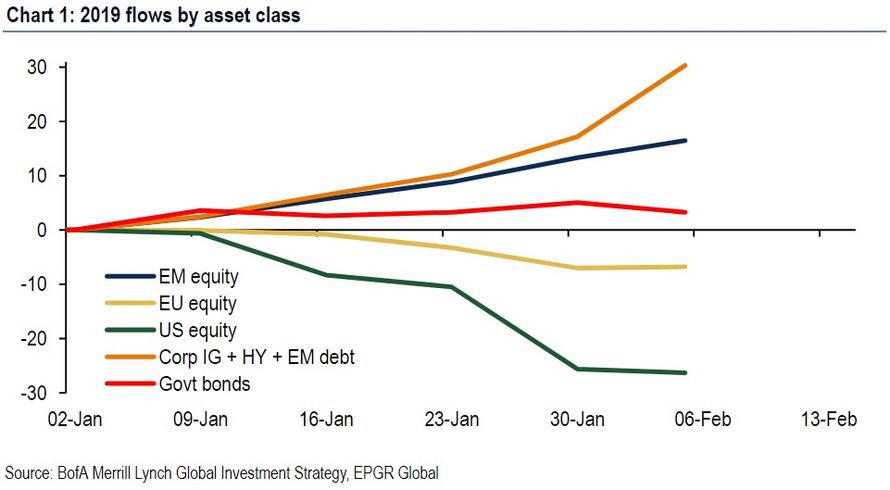

of the bigger "mysteries" of the market in 2019 has been how, with

virtually everyone selling US equities, something confirmed not only by fund flow data...

2019の市場の大きな「ミステリー」は、ほとんどみんなが米国株を売る中で、ファンドフローで見て何が起きているか・・・・

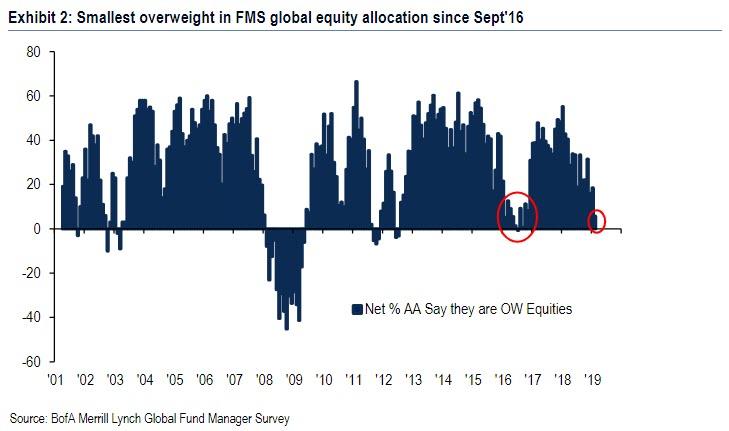

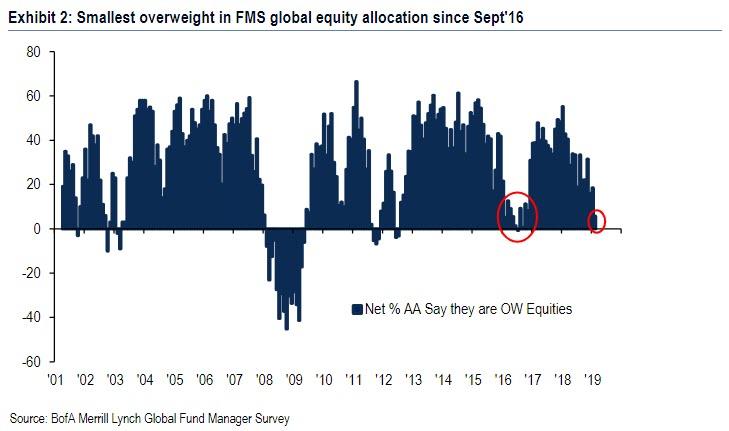

... but also the latest BofA Fund Manager Survey, which showed that that professional investors' allocation to global equities tumbled 12% to just net 6% overweight, the lowest level since September 2016, and the biggest MoM drop relative to the performance of global equities (+7% from Jan 4th start of Jan'19 survey) to Feb 7th (end of Feb'19 survey) on record...

・・・しかし最新のBoAファンドマネージャ調査では、プロ投資家の世界株式露出は12%下落し、わずか6%の過剰だ、2016年9月以来の低位となる、そして世界株式パフォーマンスからすると2月7日まででMoMで最大の下落(2019年1月4日から+7%)となる・・・・

... have stocks managed to stage not only a dramatic rebound from the December lows, but also enjoyed the best January since 1987, with the rally continuing well into February. In fact, as shown in the chart below, the YTD performance in the S&P is tied for second best since 1990 (on par with 1997) and only trailing the return of the 1991 market.

12月の安値から株式は大きく反転しただけでなく1月には1987年以来の良さだった、このラリーが2月も続いている。実際、下のチャートでも解るが、YTDパフォーマンスをみるとS&Pは1990年から二番目に良い、一番は1991年だった。

Meanwhile, the selling has continued, and according to Bank of America's latest client flow trends, last week BofAML clients were all net sellers of US equities for the second consecutive week. In fact, as BofA clarifies, all three client groups (hedge funds, institutional clients and private clients) were net sellers of US equities, with sales of both single stocks and ETFs by all three.

それと同時に、売りが続いている、BoAの最新顧客トレンドフローを見ると、先週のBoA顧客は二週連続で米国株のネット売り手だった。実際、BoAが言うように、3つの顧客グループ(ヘッジファンド、法人顧客、個人顧客)どれもが米国株の売り手で、個別銘柄ETF共に同じだった。

Worse, as BofA also discloses, its clients' six-week selling streak in equity ETFs is the longest in the bank's history (since 2017), with sales of ETFs overall (for five weeks) the longest streak since June.

悪いことに、BoAが開示するように、顧客が6週連続で株式ETFを売り越しというのは当行史上最長(2017以来)のものであり、ETFの売り越しは5週連続で6月以来の長さだ。

Which leads us to the obvious question: with everyone selling, who is buying?

To be sure, we do know that one powerful force lifting stocks higher has been short covering, which we showed recently has been instrumental in if not so much lifting stocks higher, then certainly causing further distress to hedge funds, which just as they loaded up on shorts, found themselves rushing to cover.

こうなると疑念が湧く:誰もが売っているわけで、一体誰が買い手か?それはよく知られたことで、株価を持ち上げているのはショートカバーだ、ここまで株価が上昇していないときにZeroHedgeが示した、その後確かにヘッジファンドを悩ませた、彼らもショートを積み上げていた、ファンド自身がカバーに殺到した。

But it is hardly likely that mere short selling has offset the 7 weeks of consecutive institutional and retail sales since the December lows.

しかし、12月の安値から、7週も続けて空売り解消となるのはありそうにない。

So, once again, we ask who is buying?

では、繰り返すが、誰が買っているのだろう?

As it turns out, the answer is familiar to all, and especially to those politicians such as Marco Rubio, who have waged into the highly politicized debate over stock repurchases. The answer, for those who still haven't figured it out, is stock buybacks.

分かってきたことだが、答えは皆がよく知っているものだ、特にMacro Rubioのような政治家は分かっている、彼は株式買取に関する政治的な議論を投じた。答えは自社株買いだ。

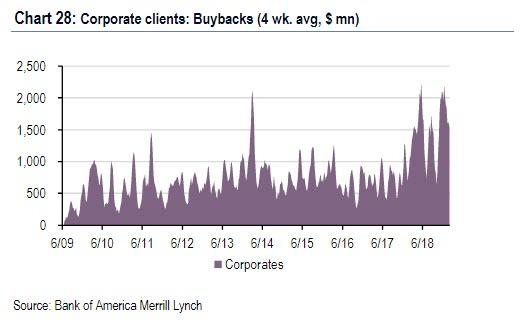

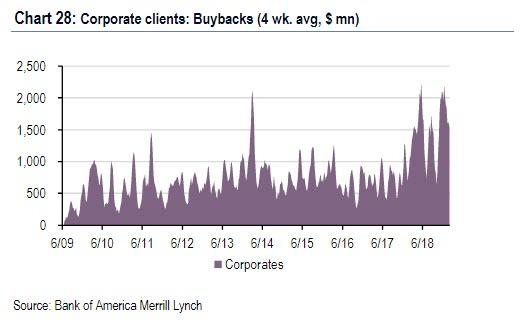

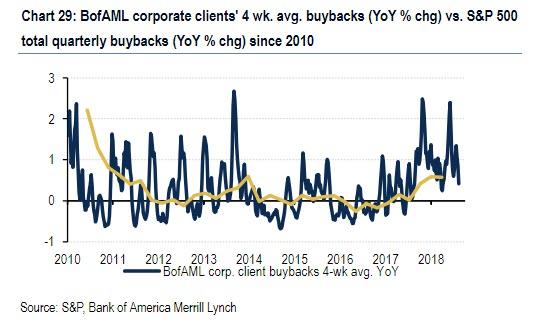

As Bank of America notes, corporate buybacks last week not only offset the selling by all of the bank's other clients, leading clients to remain aggregate buyers of single stocks overall...

BoAによると、企業の自社株買いは先週、当行の全顧客の売りを上回った、個別銘柄を積み上げた買い手になっている・・・

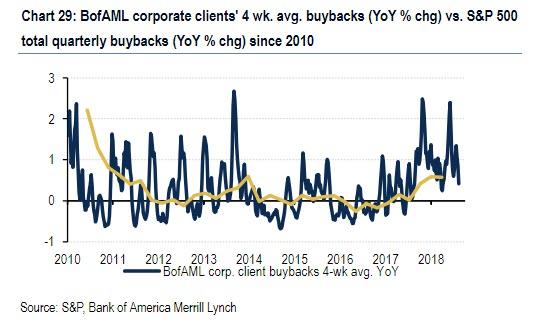

... but on a year-to-date basis, buybacks are already tracking far above last year's records, and are in fact a whopping +78% higher compared to the same period in 2018 (as a reminder, total announced buybacks in 2018 hit a record $1 trillion).

・・・しかし、YTDでみて、自社株買いはすでに昨年の記録を超えている、2018年の同時期よりも+78%にもなる(念の為に書くと、2018年通年の自社株買いは$1Tにもなった)。

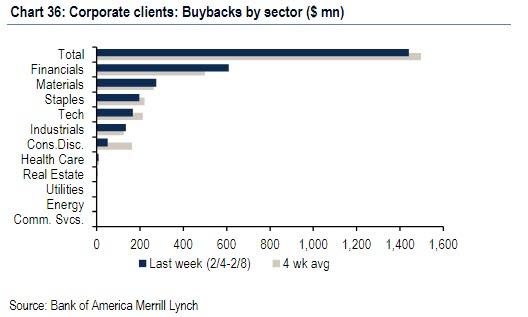

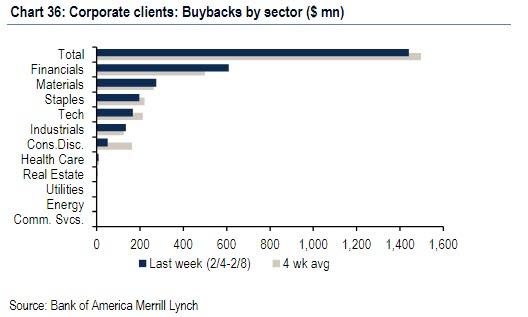

As BofA further notes, stock repurchases have affected virtually every segment, and as BofA notes, "our corporate clients were largest in Financials and Materials last week, similar to the prior week. Materials buybacks remain near record levels."

BoAはさらにこう書いている、自社株買いはほとんどすべてのセグメントで見られる、さらに「私どもの法人顧客は金融、素材で先週最大となった、その前の週と同様だ。かなりな量の自社株買いは記録的なレベルになっている。」

And while we hardly have to explain why this is a big issue, Bloomberg did it for us, writing in its mid-day recap that "stocks faded from the highs after Senator Marco Rubio announced he will soon introduce a bill to tax buybacks on an equal footing with dividends" thereby putting future buybacks (which some so-called experts continue to claim have no impact on aggregate stock prices) in jeopardy.

ZeroHedgeはこのことがどうして大問題かと今更説明しないが、ブルームバーグは場中の報告でこう伝えた「Macro Rubio上院議員が自社株買いに配当と同様に課税する法案を提出するというニュースで株式は高値から弱くなった」将来自社株買いが危ういということでだ(自社株買いの影響は大したことがないという専門家もいる)。

ZeroHedgeとしては:Marcoには注意することだ、というのもこの法案は明らかに大衆迎合を狙ったもので、Rubioの政治的立場を強くするーーたぶん民主党の大統領立候補のためのものだーー市場暴落の原因となれば一夜で政治生命を絶たれるかもしれない。

And if, as we have shown, the only buyer of stocks in 2019 is prohibited from further buying due to fears over regulation or political considerations, it is only a matter of time before the S&P crashes right back to its 2018 lows, before proceeding far lower, until such time that the "Powell Put" is retested once again, forcing the Fed to not only "pause" but launch QE4.

そしてもし、ZeroHedgeが示したように、2019年の唯一の買い手が法案や政治的な問題でさらなる買い増しを禁じられるなら、S&Pが2018年底値まで戻るのは時間の問題だ、さらなる下落の途中経過として、そうなるまでに「Powell Put」がまた再開され、FEDは「中断」するだけでなくQE4を始める。

2019の市場の大きな「ミステリー」は、ほとんどみんなが米国株を売る中で、ファンドフローで見て何が起きているか・・・・

... but also the latest BofA Fund Manager Survey, which showed that that professional investors' allocation to global equities tumbled 12% to just net 6% overweight, the lowest level since September 2016, and the biggest MoM drop relative to the performance of global equities (+7% from Jan 4th start of Jan'19 survey) to Feb 7th (end of Feb'19 survey) on record...

・・・しかし最新のBoAファンドマネージャ調査では、プロ投資家の世界株式露出は12%下落し、わずか6%の過剰だ、2016年9月以来の低位となる、そして世界株式パフォーマンスからすると2月7日まででMoMで最大の下落(2019年1月4日から+7%)となる・・・・

... have stocks managed to stage not only a dramatic rebound from the December lows, but also enjoyed the best January since 1987, with the rally continuing well into February. In fact, as shown in the chart below, the YTD performance in the S&P is tied for second best since 1990 (on par with 1997) and only trailing the return of the 1991 market.

12月の安値から株式は大きく反転しただけでなく1月には1987年以来の良さだった、このラリーが2月も続いている。実際、下のチャートでも解るが、YTDパフォーマンスをみるとS&Pは1990年から二番目に良い、一番は1991年だった。

Meanwhile, the selling has continued, and according to Bank of America's latest client flow trends, last week BofAML clients were all net sellers of US equities for the second consecutive week. In fact, as BofA clarifies, all three client groups (hedge funds, institutional clients and private clients) were net sellers of US equities, with sales of both single stocks and ETFs by all three.

それと同時に、売りが続いている、BoAの最新顧客トレンドフローを見ると、先週のBoA顧客は二週連続で米国株のネット売り手だった。実際、BoAが言うように、3つの顧客グループ(ヘッジファンド、法人顧客、個人顧客)どれもが米国株の売り手で、個別銘柄ETF共に同じだった。

Worse, as BofA also discloses, its clients' six-week selling streak in equity ETFs is the longest in the bank's history (since 2017), with sales of ETFs overall (for five weeks) the longest streak since June.

悪いことに、BoAが開示するように、顧客が6週連続で株式ETFを売り越しというのは当行史上最長(2017以来)のものであり、ETFの売り越しは5週連続で6月以来の長さだ。

Which leads us to the obvious question: with everyone selling, who is buying?

To be sure, we do know that one powerful force lifting stocks higher has been short covering, which we showed recently has been instrumental in if not so much lifting stocks higher, then certainly causing further distress to hedge funds, which just as they loaded up on shorts, found themselves rushing to cover.

こうなると疑念が湧く:誰もが売っているわけで、一体誰が買い手か?それはよく知られたことで、株価を持ち上げているのはショートカバーだ、ここまで株価が上昇していないときにZeroHedgeが示した、その後確かにヘッジファンドを悩ませた、彼らもショートを積み上げていた、ファンド自身がカバーに殺到した。

But it is hardly likely that mere short selling has offset the 7 weeks of consecutive institutional and retail sales since the December lows.

しかし、12月の安値から、7週も続けて空売り解消となるのはありそうにない。

So, once again, we ask who is buying?

では、繰り返すが、誰が買っているのだろう?

As it turns out, the answer is familiar to all, and especially to those politicians such as Marco Rubio, who have waged into the highly politicized debate over stock repurchases. The answer, for those who still haven't figured it out, is stock buybacks.

分かってきたことだが、答えは皆がよく知っているものだ、特にMacro Rubioのような政治家は分かっている、彼は株式買取に関する政治的な議論を投じた。答えは自社株買いだ。

As Bank of America notes, corporate buybacks last week not only offset the selling by all of the bank's other clients, leading clients to remain aggregate buyers of single stocks overall...

BoAによると、企業の自社株買いは先週、当行の全顧客の売りを上回った、個別銘柄を積み上げた買い手になっている・・・

... but on a year-to-date basis, buybacks are already tracking far above last year's records, and are in fact a whopping +78% higher compared to the same period in 2018 (as a reminder, total announced buybacks in 2018 hit a record $1 trillion).

・・・しかし、YTDでみて、自社株買いはすでに昨年の記録を超えている、2018年の同時期よりも+78%にもなる(念の為に書くと、2018年通年の自社株買いは$1Tにもなった)。

As BofA further notes, stock repurchases have affected virtually every segment, and as BofA notes, "our corporate clients were largest in Financials and Materials last week, similar to the prior week. Materials buybacks remain near record levels."

BoAはさらにこう書いている、自社株買いはほとんどすべてのセグメントで見られる、さらに「私どもの法人顧客は金融、素材で先週最大となった、その前の週と同様だ。かなりな量の自社株買いは記録的なレベルになっている。」

And while we hardly have to explain why this is a big issue, Bloomberg did it for us, writing in its mid-day recap that "stocks faded from the highs after Senator Marco Rubio announced he will soon introduce a bill to tax buybacks on an equal footing with dividends" thereby putting future buybacks (which some so-called experts continue to claim have no impact on aggregate stock prices) in jeopardy.

ZeroHedgeはこのことがどうして大問題かと今更説明しないが、ブルームバーグは場中の報告でこう伝えた「Macro Rubio上院議員が自社株買いに配当と同様に課税する法案を提出するというニュースで株式は高値から弱くなった」将来自社株買いが危ういということでだ(自社株買いの影響は大したことがないという専門家もいる)。

ZeroHedgeとしては:Marcoには注意することだ、というのもこの法案は明らかに大衆迎合を狙ったもので、Rubioの政治的立場を強くするーーたぶん民主党の大統領立候補のためのものだーー市場暴落の原因となれば一夜で政治生命を絶たれるかもしれない。

And if, as we have shown, the only buyer of stocks in 2019 is prohibited from further buying due to fears over regulation or political considerations, it is only a matter of time before the S&P crashes right back to its 2018 lows, before proceeding far lower, until such time that the "Powell Put" is retested once again, forcing the Fed to not only "pause" but launch QE4.

そしてもし、ZeroHedgeが示したように、2019年の唯一の買い手が法案や政治的な問題でさらなる買い増しを禁じられるなら、S&Pが2018年底値まで戻るのは時間の問題だ、さらなる下落の途中経過として、そうなるまでに「Powell Put」がまた再開され、FEDは「中断」するだけでなくQE4を始める。