中国は静かにもう一つの銀行を救済する、総資産は620B人民元

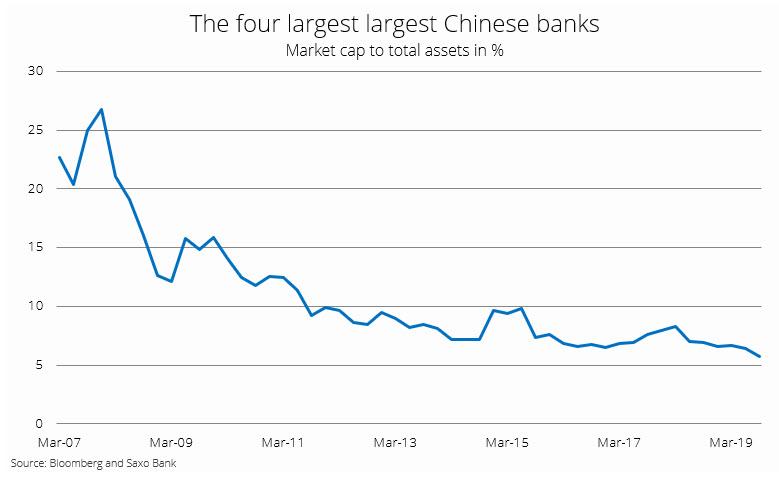

先週遅くに、ZeroHedgeはこういう記事を伝えた、小売の縮小、工業生産の縮小、企業支出は記録的な低位となりGDP成長は6%を下回るだろう、そして与信注入やクレジットインパルスは減りつつある、さらに世界第二の経済と世界最大の金融システム(約$40Tであり、米国の倍にあたる)を誇るが、下のチャートに示すように中国4大商業銀行の時価総額対全資産はこういう具合だ、Saxo Bankがこの報告を行った、Q3には過去最低の5.8%となり、全資産はQ3時点で年率8%で増えているが時価総額は下落の一途だ。

This means that Chinese investors - who happen to know best what is truly going on behind the scenes - are not valuing these new assets as high quality, and the dynamic in China right now is that the current credit expansion is just offsetting the surge in bad loans, whose real amount Beijing has been keeping under wraps ever since the great bank debt for equity swap of 1999, but which we know is far higher the propaganda number of around 1.5% The net effect is zero credit transmission to the real economy in China constraining economic growth, which in turn makes banks especially vulnerable to failure as a result of even modest capital outflows.

この状況の意味するところは、中国投資家はーー彼らは現状の裏側をよく把握しているーー注入された新規資産が高品質とはみなしていない、そして中国の現在の金融力学において単に急増する不良債権を隠すために与信拡大している、1999年のイクイティスワップによる銀行の巨額債務を北京政府は隠したままだ、しかしZeroHedgeはよく分かっている、不良債権率は1.5%と喧伝されているが、それよりも遥かに悪いものだ。与信供与が中国の実経済に影響を全く与えないために経済成長は制限を受けている、逆に言うと商業銀行は穏やかな資金流出でも特に脆弱だ。

Confirming that there is something fundamentally broken with China's debt transmission mechanism and that, by implication, Chinese bad loans are soaring, two weeks after we reported that there was a bank run at Henan Yichuan Rural Commercial Bank which brought the bank to the verge of collapse, the WSJ reported that Harbin Bank, a politically-linked midsize Chinese lender based in the capital of northeast Heilongjiang province, became the latest Chinese financial institution to get a state bailout after its key private shareholders were replaced by government investors.

中国の債務処理は何か基本的なところで破綻している、その結果、中国不良債権は急増している、2週前にZeroHedgeが報告したが、Henan Yichuan Rural Commercial Bankで取り付け騒ぎがあった、これをきっかけに当行は倒産の崖っぷちに立たされた、WSJがつたえるところでは、Harbin Bank ハルピン銀行,中国北西の黒龍江省の州都に所在し政治的に重要な中規模銀行だ、この銀行が直近の国家救済金融機関となった、重要な個人株主は政府系投資家に置き換えられた。

Harbin Bank, which is one of the biggest banks in China’s northeast with 622 billion yuan in assets as of June 30, 2019, and trades on Hong Kong’s stock exchange, becomes the fifth bank - after Baoshang Bank , Bank of Jinzhou, Heng Feng Bank, and Henan Yichuan Rural Commercial Bank - to be bailed out by the state, and will be 48%-controlled by two government entities after six private shareholders shed their stakes, according to a bank statement issued late on Friday.

Harbin Bankは中国北西部では最大銀行の一つだ、2019年6月30日時点で資産は6222B人民元になる、香港証券取引所に上場している、これが5番目の破綻銀行となったーーBaoshang Bank, Bank of Jinzhou, Heng Feng Bank そしてHenan Yichuna Rural Commercial Bankに続くものだーー国家救済を受けることになる、そして6人の個人株主はその権利を2つの政府系期間に委ねる、金曜遅くに当行が声明を出した。

Total consideration for the shares involved came to almost 15 billion yuan, or around $2.1 billion, the bank said, though it described the transactions as transfers rather than stock sales, which is to be expected if the bank was being bailed out instead of actually selling a viable stake.

As has been the customary case, the bank didn’t provide any reason for the transactions in the statement, and Chinese bank regulators made no comment on the action.

考慮すべき株式は15B人民元になる、約$2.1Bだ、と当行は言う、しかしこれは株式移転ではなく資金移動に関するものだ、権利譲渡ではなく政府から受ける救済予想額について述べている。

いつものことだが、当行はこの措置の理由についてはなにも説明がなかった、そして中国の銀行管理当局は一連の行動になんら声明を出していない。

そして、これまでの「銀行救済」と同様だが、Harbin Bankもまた失踪した元オルガリッヒと関係がある、それほど昔ではないが根拠の無い噂で溢れた人物だ。WSJが伝えるが、かつては権力を振るった大君 Xiao Jianhuaが手掛けた多くの中国本土ビジネスの一つがこの銀行だ、大物個人投資家が多数告訴されるなかで2017年始めに失踪した。こういう人たちが持っていたビジネスの多くは、たとえばWu XiaohuiのAnbang Insurance Group Co.が典型だが、それ以来国有化された。

So why did Harbin Bank fail?

ついでながら、何年ぶりかに初めて救済された小型貸し出し手であるBaoshang Bank,この件も当時ZeroHedgeが伝えたが、この銀行もXiaoに関連している。5月のこの銀行の接収をきっかけに多くの中国小型銀行が資金困難に陥りHarbin Bank株も急落した。2019年に当行の株価は16.5%下落した。ちなみに、破綻銀行の議論となると、中国PBOCはBaoschanはリストラされ、買収は金融システム全体の「止血」行為だと述べた。ではどうしてHarbin Bankは破綻したのか?

In its financial report for H1 2019, Harbin Bank cited deteriorating asset quality - read surging bad loans - as well as intensified competition for deposits and higher borrowing costs in money markets as China’s economy slows. Yet, paradoxically, the near-insolvent lender also said it recorded a profit of 2.18 billion yuan, or about $311.1 million, though that was off about 16% because of, drumroll, more-aggressive write-offs of bad debts. Which goes to show that corporate earnings reports in China are as "credible" as all other Chinese economic "data."

当行の2019H1決算を見ると、Harin Bankの不良債権が急増していたーー預金競争が激しくなりそれと同時に中国経済鈍化で資金調達コストが急増した。矛盾したことだが、破綻直前のこの貸し手は2.18B人民元の利益を上げていた、約$311.1Mにもなる、積極的に不良債権をしていたのだ。この出来事が示すのは中国の企業収益報告の「信頼性」は政府の経済統計「データ」と同程度だということだ。

今年1行のみならず2行もの銀行を破綻に導いたオルガリッヒについて、中国当局は口を閉ざしている、Xiaoは2017年始めに急に香港を立ち中国本土入りした。それ以来彼は公の場に出ることもなくコメントを出すこともない。

Another curious fact: a little over a year ago, Harbin Bank, which in March 2018 had abandoned plans to list its shares in China, announced it would raise over $2 billion in perpetual bonds to replenish its capital after regulators in early 2018 allowed lenders to sell such instruments to bolster their balance sheets.

もう一つ奇妙な事実がある:一年ほど前のことだが、2018年3月にHarbin Bankは中国本土上場を諦めた、2018年初めには当局が認めた$2Bの永久債を発行すると開示していたにもかかわらずだ、バランスシート改善のためだ。

Incidentally, a perpetual bonds is effectively the same thing as equity, but for some bizarre reason sells much better in China where the investing population is apparently stupid enough to be fooled by the clever change in designation. As such, Harbin Bank was the first Chinese lender to announce its intention to sell perpetual bonds to increase its Additional Tier 1 (AT1) capital. We now know what prompted the bank's rush.

ついでながら、永久債というのは株式と同様の効果を持つ、しかし中国固有の理由がある、当地の投資家は当局の狡猾な規制変更に従わざるを得ない。こういう状況でHarbin Bankは永久再発行でTier 1資金を調達する最初の銀行となるはずだった。今となっては我々は多数の銀行がこれに殺到したかをよく分かっている。

Harbin Bank’s exiting shareholders are business entities owned by a number of individuals, according to the company’s latest annual report. The biggest holder among them, Heilongjiang Keruan Software Technologies owned a 6.55% stake and is identified in the annual report as the subsidiary of another business primarily owned by two individuals.

Who are the bank's new owners?

直近の年次報告によるとHarbin Bankの既存株主は多くの個人投資家による企業体だ。その中でも最大手は、黒龍江省Keruan Software Technologiesで株式の6.55%を保有している、そして二人の個人投資家が持つ企業の子会社だ。

では当行の新たなオーナーは?

金曜に開示された救済策によると、Harbin市の金融当局配下の機関、Harbin Economic Development & Investment、ここが株式の29.63%を持つ、6月末には19.65%だった。二番手は、新たに18.55%の株式を持つ:黒龍江省Financial Holdings Group Co.だ、この組織は黒龍江省によって1月に設立された。これらを合算すると、国有企業がこの救済銀行の株式の約50%を保有する。

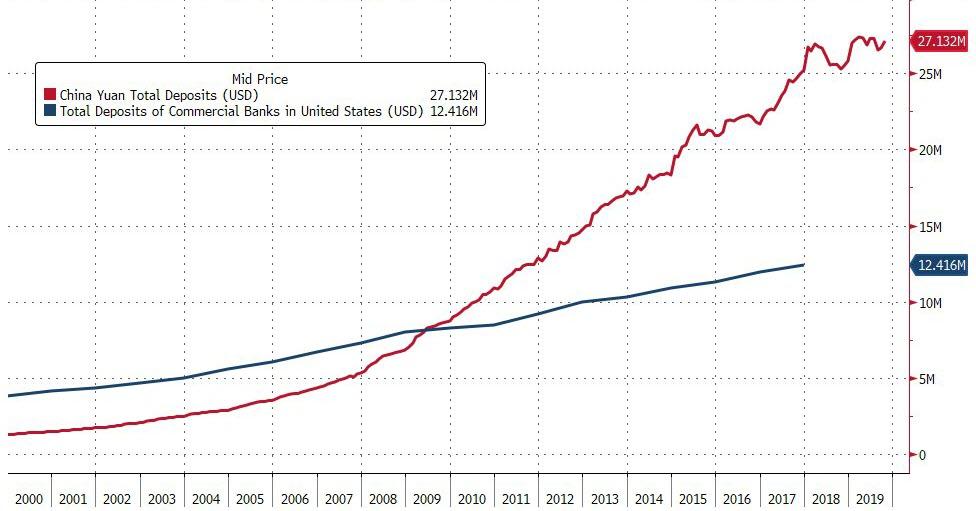

Meanwhile, since the PBOC refuses to admit or acknowledge that it has an unprecedented bad loan problem, and thus nothing can be done to address the underlying cause at the heart of China's failing bank problem, expect more and ever bigger Chinese bank bailouts until eventually a bank fails and its depositors are impacted, sparking a furious scramble by Chinese depositors across the country to redeem their roughly $27 trillion (190 trillion yuan) in bank deposits, which as a reminder, is more than double the total amount of US commercial bank deposits.

それと同時に、PBOCは前代未聞の不良債権に対するコメントを拒否しており、中国中央部に位置するこの銀国破綻の背景についても口を閉ざしている、ということはさらなる大きな中国の銀行救済が予想される、中国全土の預金者が$27Tの預金引き出しに殺到する可能性を秘めている、この資金規模は米国商業銀行の全預金規模の倍にもなる。

They are in for an unpleasant surprise.

不快な驚きだ。