ゴールド先物が伸び、8年ぶりの高値になる、Pelosiがトリリオンドルの約束をした後

多くの人が思うよりも政治家は左右を問わず財政に関して保守的な考えを持っている、そこえ武漢コロナが大きく影響を与えた、政党を超えてさらなる財政出動が望ましいと声を揃える、さらにはヘリコプターマネーはもっと良いと、そして政府債務にはどんどんゼロが増えてゆく!

今夜の直近のペロシのスピーチこうだーー次の4度目となる対ウイルス刺激策は少なくとも$1Tにすべきだーー明らかに次のことを確認している:

" Glad to see both parties supporting gold $10k..."

「喜ばしいことに両党ともにゴールドが$10Kとなることを支持している・・・・」

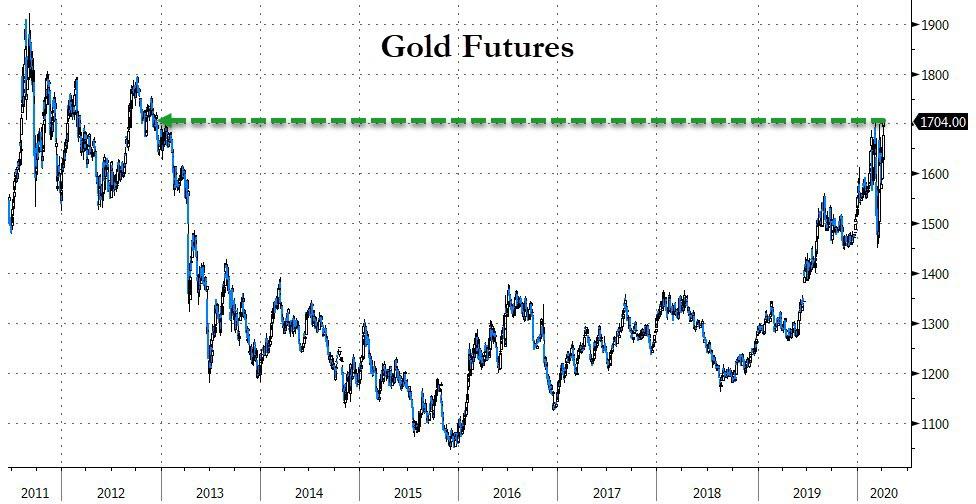

And sure enough, gold is soaring after hours following this headline...

そしてたしかに、ゴールドはこの見出し記事の後数時間で急騰した・・・・

Back to Dec 2012 highs...

2012年高値に戻った・・・・

And once again futures are decoupling from spot as that physical (geographical) shortage rears its ugly head once again...

そしてまたもや先物はスポットから乖離し始めている、現物不足がまたもや鎌首をもたげている・・・

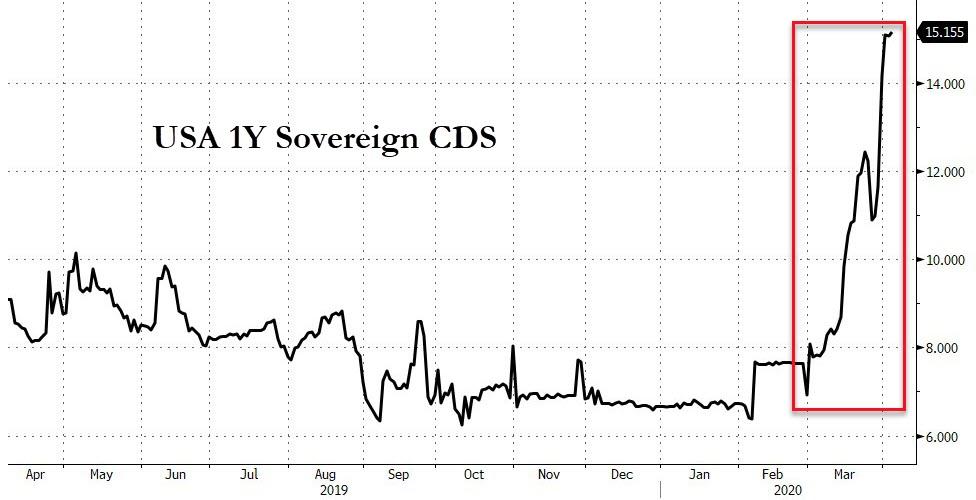

One thing is for sure, not only is gold signaling systemic risk is soaring, sovereign credit markets are starting to leak information...

一つだけ確かなことは、システマティックリスク急騰のシグナルをゴールドが発するだけでなく、国債与信市場も何らかの情報を漏らし始めている・・・・

Referring to his institutional market research at Global Macro Investor, we give the last word to Raoul Pal and his most recent thoughts (excerpted) on "A Dollar Standard Crisis" are

Raoul PalのGlobal Macro Investorに関する市場調査報告書を引用して、ZeroHedgeは彼の最近の考えを紹介しよう「ドル本位性の危機」にこう書かれている

....

Don't forget - the $13tn short dollar positions (foreign dollar debt held mainly by foreign corporation and investment vehicles) is the largest position ever taken in the history of global financial markets.

忘れてはいけないーー$13Tに及ぶドルショートポジション(海外の企業や投資家が持っているドル建て債務)は世界金融市場で史上最大の規模だ。

It can only mean a massive, uncontrolled dollar rally.

それは巨額の制御不能のドルラリーを意味している。

QE will not fix this. Swap lines will not fix this. A debt jubilee would fix this or multiple trillions of dollars in write-downs and defaults.

It is the dollar strength that brings to world to its nadir (just like the 1930s). It is the dollar system that is the really big problem.

The dollar has eaten all of its competitors and now it is going to eat itself.

QEではこの問題を解決できないだろう。スワップライン(中央銀行間の通貨融通)ではこの問題を解決できないだろう。債務免除でしか解決できないだろう、さもなくば 数トリリオンドルもの規模で倒産だ。世界を谷底に導くのはドルの強さだ(それは1930年代に起きたことだ)。ドルシステム、それ自身が大きな問題だ。ドルはその競合をすべて食い尽くし、今や自らを食いつぶそうとしている。

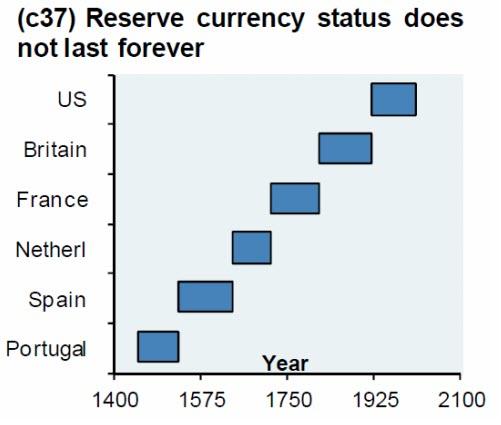

世界の中央銀行は超苦境に立たされた後やがてドルが瓦解し代替手段を見つけざるを得なくなる。

Remember, nothing lasts forever...

覚えておくが良い、世の中に永遠に続くものなどなにもないのだ・・・・

The world's elite have long wanted to replace the US dollar with a single global super-currency, as The World Bank's former chief economist said in 2014, it will create a more stable global financial system.

長年世界のエリートたちは米ドルを一つの世界超通貨で置き換えることを望んできた、元世界銀行総裁が2014年にこういった、こうすることでより安定な世界禁輸システムを構築できるだろう。

"The dominance of the greenback is the root cause of global financial and economic crises," Justin Yifu Lin told Bruegel, a Brussels-based policy-research think tank.「ドルの支配が世界的金融経済機器の根源だ」、Justin Yifu LinはBruegel に語った、ブリュセルにある政策調査シンクタンクだ。

"The solution to this is to replace the national currency with a global currency."

「この問題の解決は各国通貨を世界共通通貨に置き換えることだ。」