FEDはインフレを諦める、ようこそ United States of Japan

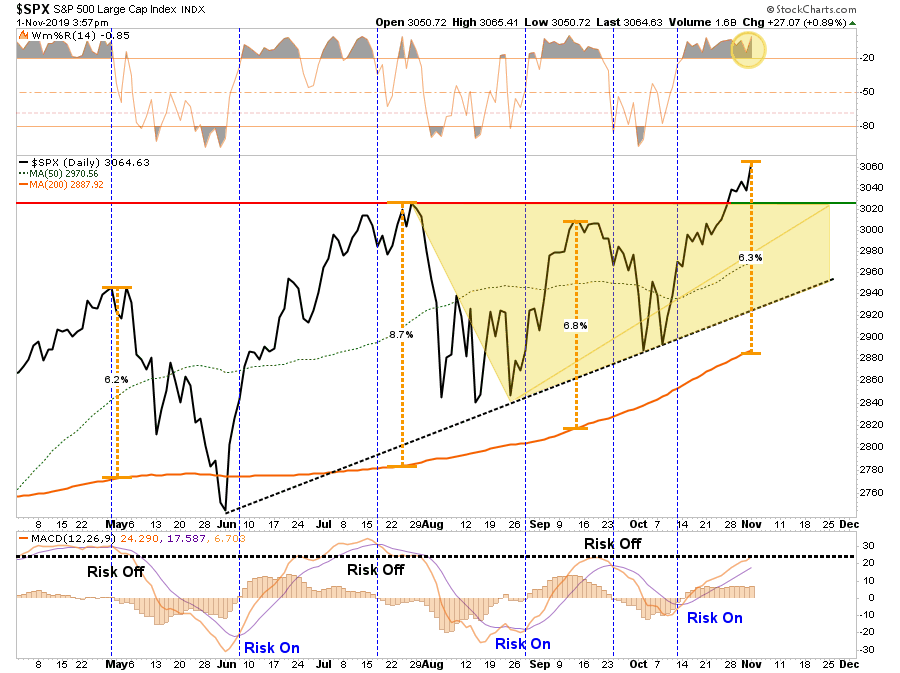

Retest Confirms Bullish Breakout

ブル相場ブレークアウトを再度試す

“If you are a bull, what is there not to love?”

「あなたがブル派なら、それはちっとも好ましいことではないのでは?」

That was the message from two weeks ago, and the reasoning behind increasing our equity exposure in portfolios as we head into the end of the year. With the Fed cutting rates on Wednesday, and companies winning the “beat the estimate game” as earnings season progresses, the markets finally broke out to new “all-time” highs this past week.

これは2週前のメッセージだ、この背景にあるのは年末に向けて株式露出を増やしていることにある。水曜にFEDが金利を引き下げ、多くの企業が「予想を上回る、ゲーム」に勝ちつつある、市場はとうとう先週過去最高を打ち破った。

This breakout is consistent with the “revival of the bulls” which is needed as there is too much attention focused on a “recession” and “bear market.” (If a recession/bear market would have occurred it would have been the first time in history “everyone” saw it coming.)

このブレークアウトは「ブルの復活」と合致しており、巷にあまりに多くの「景気後退」や「ベア相場」議論が溢れていることで必要なものだ。(もしもしここで景気後退やベア相場顔キルトすると、それは市場初めて「誰もが」それを予想する中で起きることになる。)

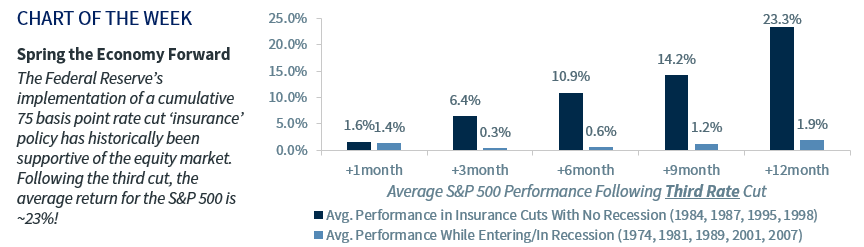

“Over the last 30 years, when the Fed has implemented an ‘insurance’ rate cut policy of 75 basis points, the equity market has been ‘lights out’ as the S&P 500 has posted a 12-month forward return of ~23%, on average.” – Raymond James

「過去30年を振り返り、FEDが「予防的措置」で75BPSも金利を引き下げた時、S&P500はその後12か月リターンが約23%にもなる」ーーRaymond James

(H/T G. O’brien)

That’s the good news.

これは良いニュースだ。

しかしながら、この見立てに両足で飛び乗る前に、幾つか注意点がある。

Concerning the chart above, you have to decide whether the recent rate cuts by the Fed are “mid-cycle adjustments” or “cuts entering a recession.” While most people only notice the tall black bars, given we are in the longest economic expansion in history, the short-blue bars may be important.

上のチャートに関して、皆さんが判断しなければならないのは最近の金利引下げは「サイクル半ばでの調整」かもしくは「景気後退入りの金利引下げ」かということだ。多くのひとはこのグラフの黒いバーにのみ目がゆくが、今我々は史上最長の景気拡大期にいる、横に示した短い青バーが重要かもしれない。

Again, since bear markets/recessions NEVER occur when everyone is expecting them, the breakout to new highs is exactly what is needed to “suck investors” back into the market at the potential peak. This is how bear markets have always begun in history.

繰り返しになるが、ベア相場や景気後退は皆が予想しているときには決して起きないわけで、新高値ブレークアウトというのは潜在的なピークへと「投資家を騙す」ために必要なものだ。歴史を振り返るとベア相場がどういうふうに始まるかを示している。

On a shorter-term basis, whether you are bullish or bearish, the market is now more than 6% above its 200-dma. These more extreme price extensions tend to denote short-term tops to the market, and waiting for a pull-back to add exposures has been prudent.

短期的には、皆さんがベア派であろうとブル派であろうとそれには無関係に、相場は今や200DMAから6%上方乖離している。これほどの相場の行き過ぎというのは短期的な天井となりやすい、そして露出を増やすには引き戻しを待つのが規律ある行動だ。

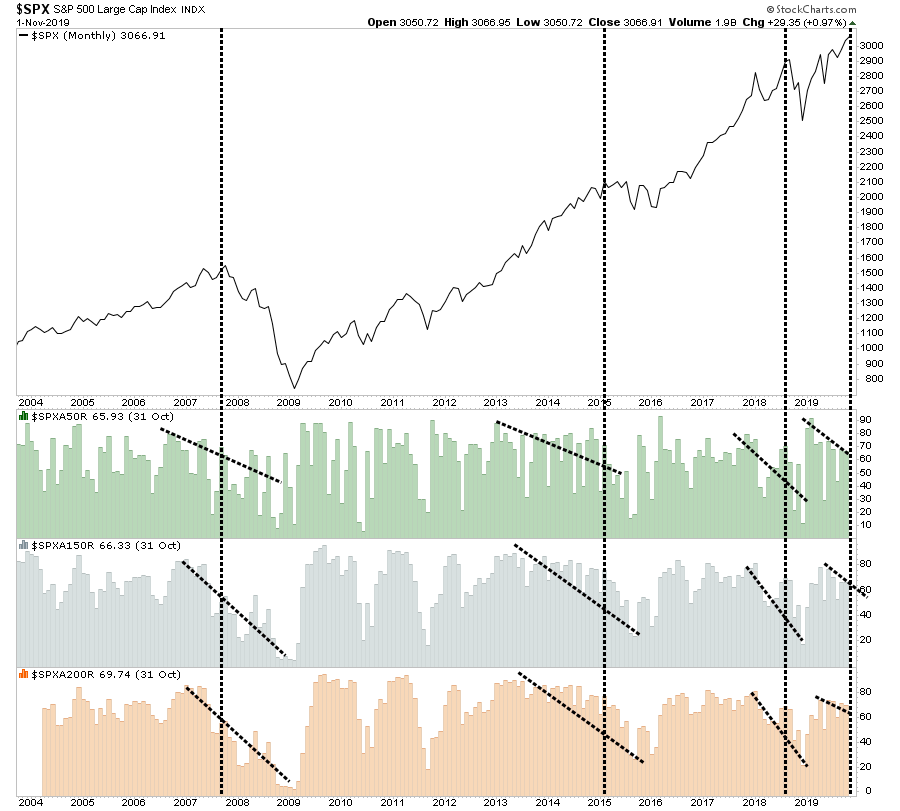

The other concern is the weakness in overall participation in the market. Despite the markets pushing to all-time highs, the number of stocks trading above their respective 50, 150, and 200-dma’s remain in downtrends. These negative divergences have preceded short to intermediate-term corrections in the past.

もう一つの懸念は市場参加者全体の懸念だ。相場は過去最高となるが、50DMA,150DMAそして200DMAを上回る銘柄の数は減る傾向にある。このようなマイナス乖離はこれまで中短期的調整の前兆となってきた。

How To Play It

相場にどう対応するか

私どもが先月来主張してきたが、FEDがより緩和的姿勢を見せる中で、私どもは引き続き現在のポートフォリオで株式ロングのままだ。私どもはヘッジを減らしてきた、防御的なポジションを増やしながらだ。私どもはまた株式露出の機会を伺っている、ただし通常よりも現金と金利商品の割合を増やしてはいる。

We also realize that “all good things do come to an end.” While we are currently “riding the bull,” we are simply waiting for the “8-second buzzer” to prepare for our dismount. (That’s a Texas rodeo thing if you don’t know the reference.)

私どもはまた分かっている「どんな良いことにもやがて終わりが来る」。私どもは現在「ブル相場に乗っている」が、逃げ出すための「緊急ブザー」を待っているに過ぎない。

しかるに、すべてのポジションのストップロス設定を確認することだ、そしてその発動に備えることだ。投資家がいつもやってしまう最悪のことは、結局は売りで終わるのに「勝ち馬」から「負け馬」になることだ。(いつも最後は売ることになる)。

While you will certainly reduce your tax liability with this method, it is not a strategy by which you will increase your wealth. Being “rich on paper” and having “cash in the bank” are two ENTIRELY different things.

こういう方法で税金をへらすことはできるかもしれないが、こういう方法で資産を増やすことはできない。「帳簿上の黒字」と「銀行口座の現金」は全く別物だ。

The Fed Gives Up On Inflation

FEDはインフレを諦めた

水曜にFEDは今年3度目となる金利引下げを行った、これは市場が待ち望んでいたものだ。

市場が予想していなかったのは次の一文だ。

“I think we would need to see a really significant move up in inflation that’s persistent before we even consider raising rates to address inflation concerns.” – Jerome Powell 10/30/2019

「インフレ懸念から金利引き上げを再考するには定常的に大きなインフレを確認する必要があると、私は考えている。」Jerome Powell 10/30/2019

The statement did not receive a lot of notoriety from the press, but this was the single most important statement from Federal Reserve Chairman Jerome Powell so far. In fact, we cannot remember a time in the last 30 years when a Fed Chairman has so clearly articulated such a strong desire for more inflation.

この主張はメディアでそれほど注目を集めていない、しかしこの言葉はFED議長Jerome Powllから発せられる最も重要なものだ。実際、この30年、我々はFED議長がここまでさらなるインフレを強く求める発言を見たことが無い。

Why do we say that? Let’s dissect the bolded words in the quote for further clarification.

どうして私どもがそういうかって? 彼の言葉をさらに詳細に分析してみよう。

-

“really significant”– Powell is not only saying

that they will allow a significant move up in inflation but going one

better by adding the word significant.

「really significant」ーーPowellが言うには、単に大きなインフレを許容するだけでなく、このことば「significant」を付け加えたのだ。

-

“persistent”– Unlike the prior few Fed Chairman

who claimed to be vigilant towards inflation, Powell is clearly telling

us that he will not react to inflation that is not only well beyond a

“really significant” leap from current levels, but a rate that lasts for

a period of time.

「persistent」ーーインフレを警戒するこれまでのFED議長とは異なり、Powellは明確にこう述べている、インフレレベルが現在よりも「really significant」にならない限り対処しないと、またある程度の期間持続しないと対処しないと言っている。

-

“even consider”– If inflation is not only a

really significant increase from current levels and stays at such levels

for a while, they will only consider raising rates to fight inflation.

「even consider」ーーもしインフレが現状よりもかなり大きくまた持続したとしても、インフレに対処するための金利引き上げを検討するだけだろう。

私どもはPowellの言葉の選択に驚いている、これがFEDのインフレに対する見解なのだ。私どもがもっとショックを受けたのは市場やメディアがこのことに注目しないことだ。

Maybe, they are failing to focus on the three bolded sections. In fact, what they probably think they heard was: I think we would need to see a move up in inflation before we consider raising rates to address inflation concerns. Such a statement would have been more in line with traditional “Fed-speak.”

多分彼らは、3つの強調事項に反応していない。実際これまで彼らが耳にしてきたのはこういう文章だ:私が思うに、インフレ懸念で金利引き上げを検討する前にインフレ増加を確認する必要がある。「FED-speak」においてはこういう論調が普通に使われていた。

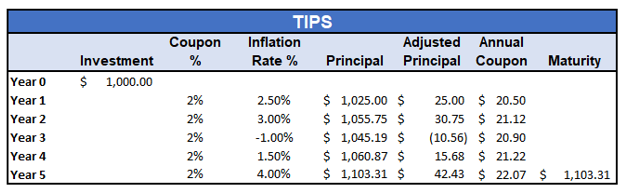

We have published an article for our RIAPro subscribers (Try a FREE 30-Day Trial), which discusses our views on using Treasury Inflation-Protected Securities (TIPS), a hedge against Jerome Powell and the Fed getting inflation, or worse, failing and fostering deflation.

私どもはRIAPろ読者にはこういう記事を提供した、TIPSの動きを見ての私どもの見解を示すものだ、Jerome PowellやFEDのインフレ対処、最悪の場合はデフレに陥る場合にそなえてのヘッジだ。

There is an other far more insidious message in Chairman Powell’s statement which should not be dismissed.

そこにはPowell議長のメッセージが隠されている、これは無視すべきではない。

The Fed just acknowledged they are caught in a “liquidity trap.”

FEDはまさに「流動性の罠」に捕らわれていることを自白しているのだ。

What Is A Liquidity Trap

流動性の罠 とはなにか

その定義はこうだ:

“A liquidity trap is a situation described in Keynesian economics in which injections of cash into the private banking system by a central bank fail to lower interest rates and hence fail to stimulate economic growth. A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war. Signature characteristics of a liquidity trap are short-term interest rates that are near zero and fluctuations in the monetary base that fail to translate into fluctuations in general price levels.”

「流動性の罠とは、中央銀行がもはや金利引下げでの景気刺激策不能となったときに民間銀行システムに現金を注入する状況をケインズ経済で表現したものだ。流動性の罠が生じるのは人々がデフレや不十分な需要、戦争等を予感し現金を溜め込むときに生じる。流動性の罠の特徴は、金利が殆どゼロになり、マネタリーベース変動で物価変動を引き起こせないことだ。」

Let’s take a moment to analyze that definition by breaking it down into its overriding assumptions.

この定義をもうすこし噛み砕き重要な想定を分析してみよう。

- Are the Central Banks globally injecting liquidity into the financial system? Yes.

世界の中央銀行は金融システムに流動性注入を行っているだろうか? Yes. - Has the increase in liquidity into the private banking system lowered interest rates? Yes.

民間銀行システムに流動性注入で金利はさがっているだろうか? Yes.

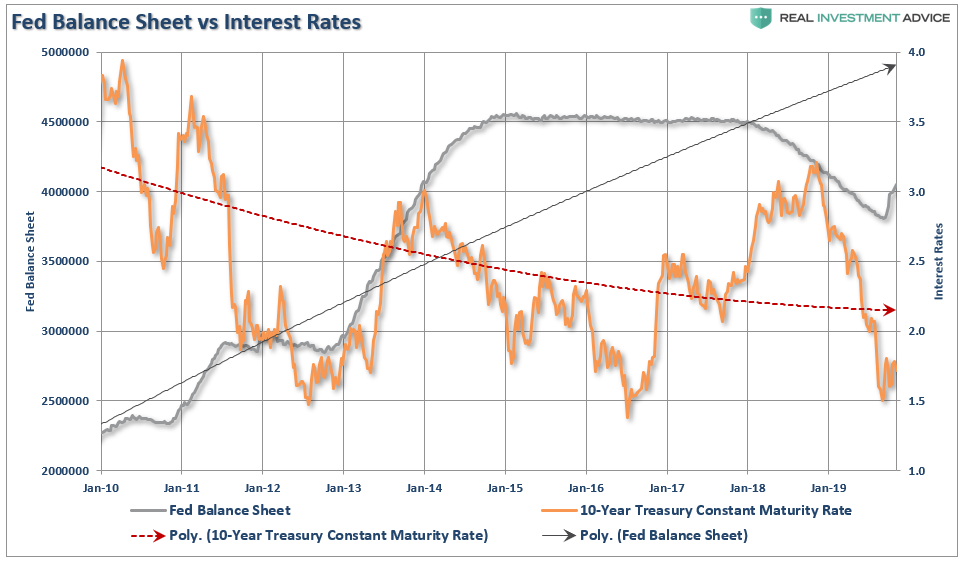

下のチャートはFEDのバランスシートを示す、というのも彼らが国債の「買い手」だからだ、これが大手銀行の超過準備口座をふくらませる、これと10年もの国債金利を比べている。

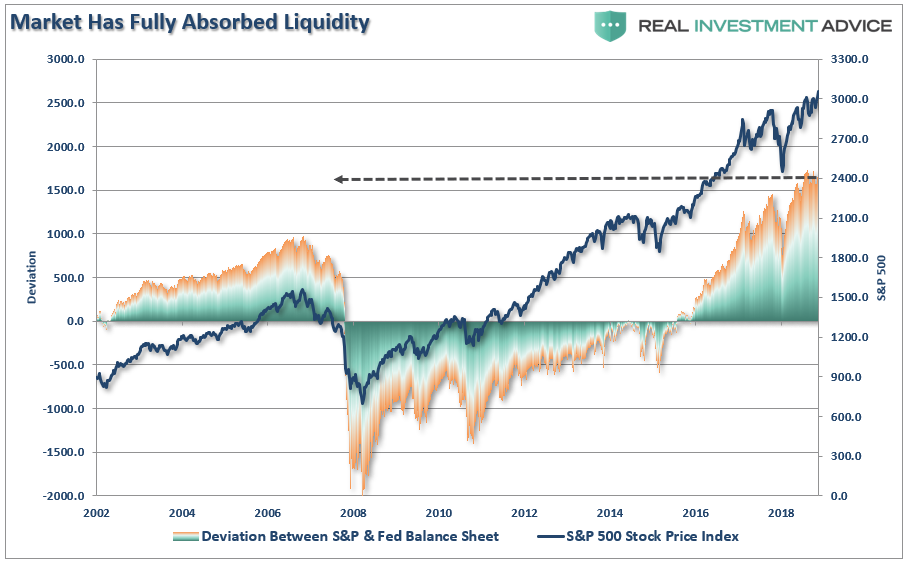

Of course, that money didn’t flow into the U.S. economy, it went into financial assets. With the markets having absorbed the current levels of accommodation, it is not surprising to see the markets demanding more, (The chart below compares the deviation between the S&P 500 and the Fed’s balance sheet. That deviation is the highest on record.)

当然のことながら、これらのマネーは米国経済には流入しない、金融資産に向かう。現在の緩和レベルでも市場は吸収しており、市場がさらなる要求をしても驚きはしない、(下のチャートはS&P500とFEDバランスシートを比べている。その乖離は過去最高となっている。)

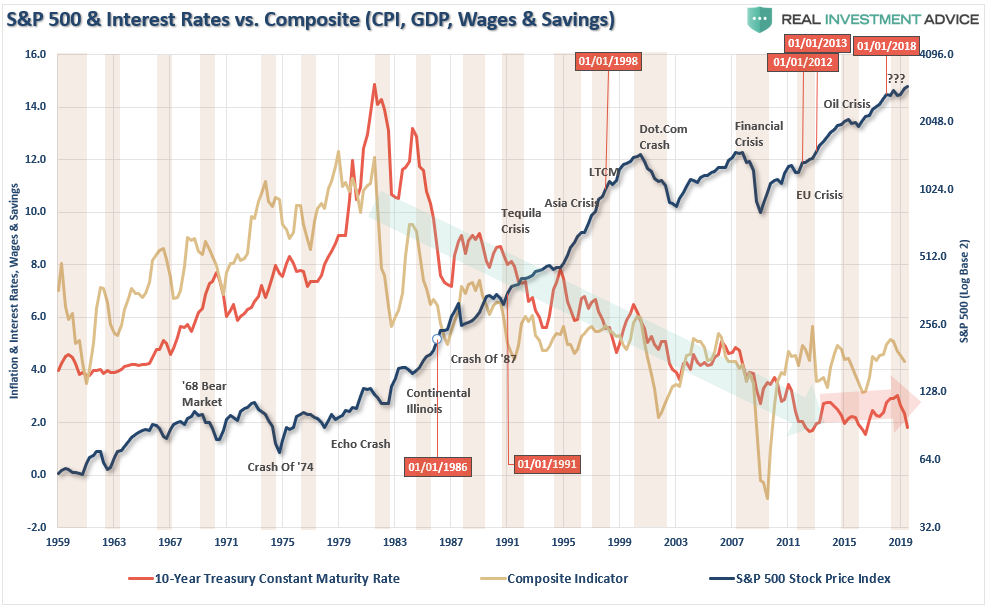

While, in the Fed’s defense, it may be clear the Fed’s monetary interventions have suppressed interest rates, I would argue their liquidity-driven inducements have not done much to support durable economic growth. Interest rates have not been falling just since the monetary interventions began – it began four decades ago as the economy began a shift to consumer credit leveraged service society. The chart below shows the correlation between the decline of GDP, Interest Rates, Savings, and Inflation.

一方でFED側に立てば、FEDの金融介入というのは金利引下げであるのは明らかだ、流動性による安定的経済成長はできないことに私も合意する。金融介入が始まってから金利が下がってきたわけではないーー金利低下が始まったのはもう40年も前のことであり、経済システムが消費者の借金によるレバレッジに支えられるようにシフトしてきたときからだ。下のチャートはGDP成長率と、金利、預金率、そしてインフレの相関を示す。

In reality, the ongoing decline in economic activity has been the result of declining productivity, stagnant wage growth, demographic trends, and massive surges in consumer, corporate and, government debt.

実際には、現在起きている経済活動の鈍化は各種要因が複合的に寄与しているためだ、生産性低下、給与増加の停滞、人口動態変化、そして消費者・企業・政府の巨額債務。

For these reasons, it is difficult to attribute much of the decline in interest rates and inflation to monetary policies when the long term trend was clearly intact long before these programs began.

要因は多岐にわたり、金利やインフレ低下を金融政策のせいにするのは難しい、金融政策プログラム開始のずっとまえからこのトレンドは続いているのだ。

While an argument can be made that the early initial rounds of QE contributed to the bounce in economic activity, there were several other more important supports during the latest economic cycle.

最初のQEに関しては経済活動活性化に寄与すると解説されてきたが、景気サイクルが進行するにつれてさらに他にも重要な景気刺激策が取られた。

-

Economic growth ALWAYS surges after recessionary weakness. This

is due to the pent up demand that was built up during the recession and

is unleashed back into the economy when confidence improves.

景気後退の後にはいつも経済成長は急激なものだ。景気後退期に積み上げられた需要が上乗せされるからであり、そして信頼感が回復するとこの需要が解き放たれる。

-

There were multiple bailouts in 2009 from “cash for

houses”, “cash for clunkers”, to direct bailouts of the banking system

and the economy, etc., which greatly supported the post-recessionary

boost.

2009年には多くの補助政策が実行された、「住宅減税」、「自動車減税」、銀行システムや経済システムへの直接補助、等々、これらが景気後退後の経済拡大を加速させた。

-

Several natural disasters from the “Japanese

Trifecta” which shut down manufacturing temporarily, to massive

hurricanes and wildfires, provided a series of one-time boosts to

economic growth just as weakness was appearing.

「日本の大災害」で一時的に製造業が鈍化したり、巨大ハリケーンや山火事のような自然災害があった、景気が弱まるときにこの一時的な効果が景気を刺激してきた。

-

A massive surge in government spending which directly feeds the economy

政府の巨額な支出が直接景気を刺激した。

2010年からのFED介入は、FEDは「もうこれしかない」という具合に株価に巨大なインフレを引き起こしそれ以外にはほとんど効果がなかった。その証拠は明らかだがFEDの金融政策の見返りはどんどん薄れていった。

Welcome To The U.S. Of Japan

ユナイテッド・ステーツオブジャパンにようこそ

この30年日本が陥った「流動性の罠」にFEDも捕まった。人口高齢化、これは引き続き金融システムに緊張を引き起こすだろう、債務のさらなる増加と非生産的な財政政策は経済成長の足を引っ張る、金融政策は単に金融資産のブーム/バストサイクルを引き伸ばす効果しかないだろう。

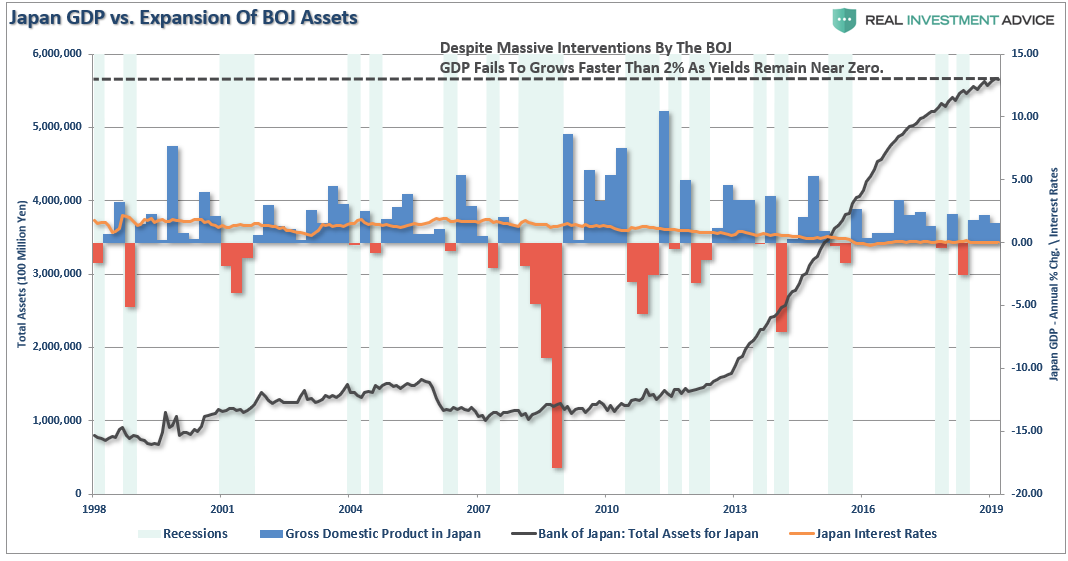

The chart below shows the 10-year Japanese Government Bond yield as compared to their quarterly economic growth rates and the BOJ’s balance sheet. Low interest rates, and massive QE programs, have failed to spur sustainable economic activity over the last 20 years. Currently, 2, 5, and 10 year Japanese Government Bonds all have negative real yields.

下のチャートは日本国債10年もの金利と四半期ごとのGDP成長率、そしてBoJバランスシートを比較している。低金利と巨額QEプログラムをもってしてもこの20年持続的な経済成長を実現できていない。現在のところ日本国債の2,5,10年物は名目値でマイナス金利だ。

The reason you know the Fed is caught in a “liquidity trap” is because they are being forced to lower rates due to economic weakness.

FEDが「流動性の罠」に陥った理由は皆さんもご存知の通り、彼らが経済の弱さで低金利を余儀なくされているからだ。

It is the only “trick” they know.

これは単なる「ごまかし」に過ぎないことは彼らもよく知っている。

Unfortunately, such action will likely have little, or no effect, this time due to the current stage of the economic cycle.

残念なことにこういう政策はほとんど、or 全く効果を持たない、それは景気サイクルの中で現在の位置を見ればわかることだ。

If interest rates rise sharply, it is effectively “game over” as borrowing costs surge, deficits balloon, housing falls, revenues weaken and consumer demand wanes. It is the worst thing that can happen to an economy that is currently remaining on life support.

もし金利が急騰すると、それは実質的に「ゲームオーバー」となり、債務コストが急騰し、財政赤字が膨らむ、住宅販売は急落、売上は弱まり消費者需要は減退する。現在経済は救命措置を施しているわけで、最悪の状態に陥る。

The U.S., like Japan, is clearly caught in an on-going “liquidity trap” where maintaining ultra-low interest rates are the key to sustaining an economic pulse. The unintended consequence of such actions, as we are witnessing in the U.S. currently, is the ongoing battle with deflationary pressures. The lower interest rates go – the less economic return that can be generated. An ultra-low interest rate environment, contrary to mainstream thought, has a negative impact on making productive investments and risk begins to outweigh the potential return.

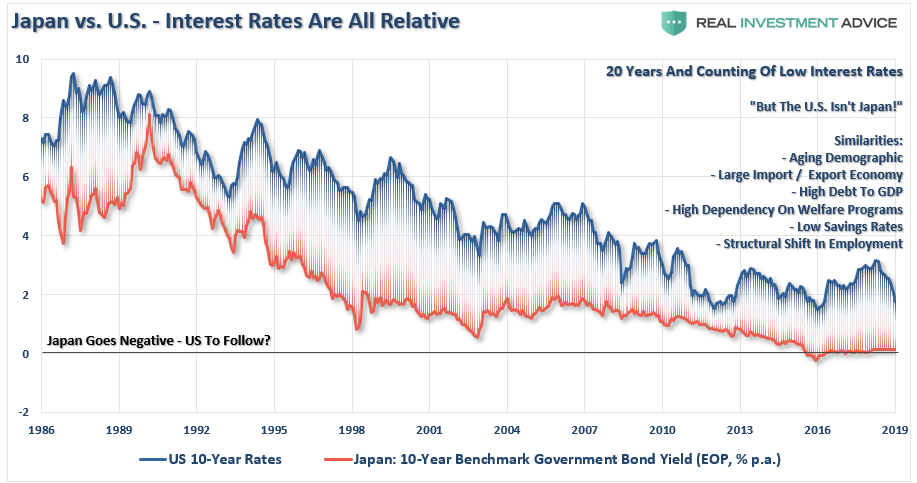

Most importantly, while there are many calling for an end of the “Great Bond Bull Market,” this is unlikely the case. As shown in the chart below, interest rates are relative globally. Rates can’t rise in one country while a majority of economies are pushing negative rates. As has been the case over the last 30-years, as goes Japan, so goes the U.S.

日本と同様に、米国は現在「流動性の罠」に捕らわれられており、経済の脈拍を維持するために超低金利維持が必須となっている。意図しない結末を迎え、現在米国でそれを目の当たりにしている、今まさにデフレ圧力と戦っているわけだ。低金利が続く限りーー経済活性化は起こりそうにない。超低金利環境では、主流派の考えとは逆に、生産的な投資にはマイナスインパクトとなり、リスクが潜在的なリターンを上回る。最も大切なことは、多くの人は「素晴らしい債権ブル相場」の終わりを告げるが、そうはなりそうにない。下のチャートを見れば解ることだが、金利というのは世界との比較で判断すべきものだ。圧倒的多数の国がマイナス金利を採用する中で一刻だけが金利を引き上げることはできない。過去30年の間日本がやり過ごしてきたように、米国もなるだろう。

Simply pulling forward future consumption through monetary policy continues to leave an ever-growing void in the future that must be filled. Eventually, the void will be too great to fill.

現在の金融政策は単に将来の消費を先食いしているだけであり、本来あるべき将来の消費の穴をどんどん大きくしているだけだ、この穴はどんどん大きくなり埋め合わすことはできないだろう。

But hey, let’s just keep doing the same thing over and over again, which hasn’t worked for anyone as of yet, and continue to hope for a different result.

What’s the worst that could happen?

でもね、こういうことを何度も何度も繰り返すだけなら、やがて効果は無くなる、それでも何らかの結果を期待して政策を維持し続ける。

最悪の事が起きると思わないかい?