そしてまたもや:数日前に政府発行の$4.1Bの債権をFEDが現金化

日銀と同じことをFEDがしています。米国でも政府債権のFED直接買い取りは禁じているので、一旦ディーラーに買い取らせ数日後にFEDが現金化するのです。

And Again: The Fed Monetizes $4.1 Billion In Debt Sold Just Days Earlier

ここ数週のFED QE4の詳細を見ると、ZeroHedgeが示すように、今やNew York FEDは連邦政府が数日前に発行したT−Bill 短期国債を積極的に買い取っていた。念の為に書くが、FEDは政府からの債務直接買い取りを禁じれらている、これは米国財政赤字の「債務現金化」とみなされ、「ヘリコプター・マネー」と等価だからだ、そしてこういう行為は議会や既存エコノミストからは眉をしかめられる。しかしながら、政府の債券発行とFEDの買取の間に3日の間を置くと・・・誰も気にしなくなる。ZeroHedgeはこう要約した:

"for those saying the US may soon unleash helicopter money, and/or MMT, we have some 'news': helicopter money is already here, and the Fed is now actively monetizing debt the Treasury sold just days earlier using Dealers as a conduit... a "conduit" which is generously rewarded by the Fed's market desk with its marked up purchase price. In other words, the Fed is already conducting Helicopter Money (and MMT) in all but name. As shown above, the Fed monetized T-Bills that were issued just three days earlier - and just because it is circumventing the one hurdle that prevents it from directly purchasing securities sold outright by the Treasury, the Fed is providing the Dealers that made this legal debt circle-jerk possible with millions in profits, even as the outcome is identical if merely offset by a few days"

「米国はすぐにもヘリコプターマネーをばらまくかもしれないと言う人に対して、ZeroHedgeは「ニュース」を伝えよう:すでにヘリコプターマネーはばらまかれている、FEDはいまや数日前に発行された米国債を積極的に現金化している、ディーラーを仲介として・・・この「仲介役」にはFED買取価格で大盤振る舞いが施される。言い換えるとすでにFEDはヘリコプターマネ(そしてMMT)を実行している、その名前が違うだけだ。上に示したように、FEDは3日前に発行された短期国債を現金化しているーー財務省が発行した国債の直接現金化を回避するためだけにだ、この合法的な債務循環でディーラーは巨額の利益を上げている、単に数日時間調整するだけでその結末は同じことだ」

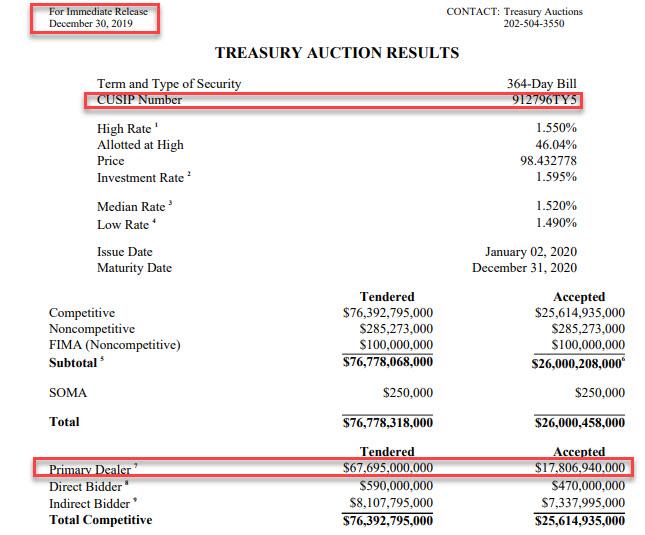

So, predictably, fast forward to today when the Fed conducted its latest T-Bill POMO in which, as has been the case since early October, the NY Fed's market desk purchased the maximum allowed in Bills, some $7.5 billion, out of $25.3 billion in submissions. What was more notable were the actual CUSIPs that were accepted by the Fed for purchase. And here, once again, we find just one particular issue that stuck out: TY5 (due Dec 31, 2020) which was the most active CUSIP, with $4.136BN purchased by the Fed, and TU3 (due Dec 3, 2020) of which $905MM was accepted.

というわけで予想通り、今日もまたFEDは最新T-BillのPOMOMを行った、これは10月初め以来ずっとだ、NY FED市場デスクは許される限りのBillsを買い取っている、$25.3Bのうちの$7.5Bだ。最も顕著なのはFEDが買い取った証券の実際のCUSIP証券番号を見ればわかることだ。ここに再掲するが、特に顕著な例だ:TY5(2020年12月31日発行)が最も注目されるものでFEDが$4.136B買い取った、そしてTU3(2020年12月3日発行)は$905Mを引き受けている。

どうしてこのCUSIP証券番号に注目するか?その理由は金曜にZeroHedgeが示したことだが、FEDはPrimary Dealersと共同して公開市場で巧みに発行されたばかりの債権の現金化を行っている。そして確かにTY5は一週間前12月30日月曜に発行し、1月2日に約定した、今日のPOMOの数日前のことだ、ディーラーは総額で$17.8Bを引き受けている・・・。

... and just a few days later turning around and flipping the Bill back to the Fed in exchange for an unknown markup. Incidentally, today the Fed also purchased $615MM of CUSIP UB3 (which we profiled last Friday), which was also sold on Dec 30, and which the Fed purchased $5.245BN of last Friday, bringing the total purchases of this just issued T-Bill to nearly $6 billion in just three business days.

In keeping with this trend, the rest of the Bills most actively purchased by the Fed, i.e., TP4, TN9, TJ8, all represent the most recently auctioned off 52-week bills...

・・・そして数日後にはこの証券はFEDの手に渡っている、買取価格は不明だ。たまたま、FEDは$615MのCUSIP UB3(ZeroHedgeが先週金曜に示したものだ)を買い取った、これは12月30日に売り出されたものだ、そして先週金曜にFEDは$5.245Bを買取り、わずか3営業日でFEDは発行されたばかりのT-Billを訳$6B購入した。この傾向が続いており、残りのBillsもFEDに買い取られている、i.e., TP4, TN9, TJ8、どれもが最近オークションにかかった52週満期の短期債権Billsだ・・・・

... confirming once again that the Fed is now in the business of purchasing any and all Bills that have been sold most recently by the Treasury, which is - for all intents and purposes - debt monetization.

・・・・再度確認すると、FEDはいまや財務省発行のすべての短期証券Billsを買い取っている、その目的はーーー債務現金化だ。

As we have consistently shown over the past week, these are not isolated incidents as a clear pattern has emerged - the Fed is now monetizing debt that was issued just days or weeks earlier, and it was allowed to do this just because the debt was held - however briefly - by Dealers, who are effectively inert entities mandated to bid for debt for which there is no buyside demand, it is not considered direct monetization of Treasurys. Of course, in reality monetization is precisely what it is, although since the definition of the Fed directly funding the US deficit is negated by one small temporal footnote, it's enough for Powell to swear before Congress that he is not monetizing the debt.

ZeroHedgeはここ数週ずっと明らかにしてきたが、これは突発的な出来事ではないーー今やFEDは数日から数週前に発行された政府債務をすべて現金化している、その手法は短期的にディーラーに買い取らせるというものだ、彼らにとって積極的に買いに動く理由はない、こうすることで直接の国債現金化を回避できる。当然のことながら現実には債務現金化そのものだが、Powllは議会でそうではないと言い訳できる。

Oh, and incidentally the fact that Dealers immediately flip their purchases back to the Fed is also another reason why NOT QE is precisely QE4, because the whole point of either exercise is not to reduce duration as the Fed claims, but to inject liquidity into the system, and whether the Fed does that by flipping coupons or Bills, the result is one and the same.

ディーラーが買い取った債権をFEDに転売することで NOT QEはQE4出ないという言い訳にもなる、時間差をおいているがシステムに流動性を注入していることに変わりはない。